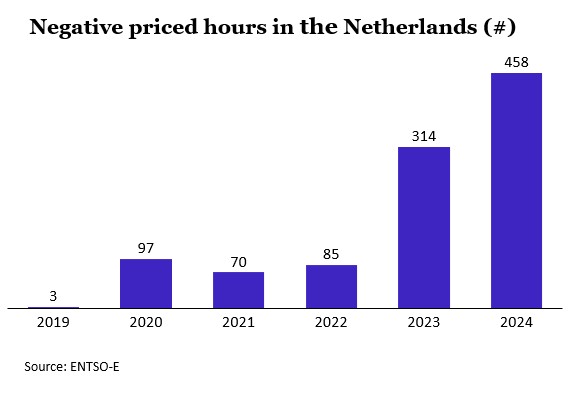

The Rise of Negative Power Prices in the Netherlands

The Rise of Negative Power Prices in the Netherlands

In 2024, the Netherlands experienced 458 hours of negative electricity prices. During these hours, producers had to pay to supply electricity instead of being paid for it. Also under the new subsidy scheme, no subsidy is provided during production when prices are negative. This forces solar farms to either shut down production or charge battery systems (if available) during these periods. As the negative prices tend to happen during the most productive hours the impact is substantial and even with subsidy the viability might not be positive. Especially given the fact that there is no guarantee on predictions for negative power prices.

In the case of a co-located battery the question that comes up is why would you charge from your solar park if you can get paid to charge from the grid. Price levels down to 0 will still result in production being compensated at the subsidy tariff (provided the yearly average is above a certain threshold). Below 0 the trade-off needs to be made taking into account a.o. daily spread, grid limitations, grid-tariffs and energy tax to determine when it’s more beneficial to charge from solar or from grid. These are not straight forward calculations and the result could be that a major part of the charging is from the grid. A co-located battery will however definitely help to diversify and make better use of the (existing) grid connection and thereby make your investment case more robust.

Apart from project specific business cases Birdview Energy is developing future market scenarios that take into account the dampening effect of batteries on price extremes. While negative prices are likely to remain part of the energy transition for the coming years, batteries offer a path to a more balanced electricity market.